Configuring Tungsten AP Essentials for use with E-conomic

Each E-conomic company corresponds to a customer in Tungsten AP Essentials.

Company mapping

Each E-conomic company corresponds to a customer in Tungsten AP Essentials. Multiple customers cannot share the same E-conomic account. You can authenticate E-conomic using a company user or an administrator using an administration agreement number.

Email input service settings

Email input settings can be adjusted by an administrator in the Email input service settings.

Extraction service settings

The Extraction service settings determine how invoice information is captured and interpreted. Do not confuse these fields with coding fields, which are used during approval.

These fields can be extracted and sent to E-conomic:

| InvoiceCredit | Determines whether the document is an invoice or a credit note. |

| InvoiceDate | The document date. |

| InvoiceDueDate | The document due date. |

| InvoiceNumbe | The document reference. |

| InvoiceTotalVatAmount | The total VAT amount of the document. |

| InvoiceTotalVatRatePercent | The total VAT rate (%) of the document. |

| InvoiceTotalVatExludedAmount | The net amount of the document. |

| InvoiceTotalVatIncludedAmount | The gross amount of the document. |

| InvoiceCurrency | The document currency code. |

See also:

Custom fields

You can use Tungsten AP Essentials to create additional custom fields that can be configured to create a tight integration with E-conomic.

The E-conomic integration supports custom fields such as:

Payment type

Used for Danish invoices, the Payment Type field specifies the invoice payment type. You can use this field with the Danish payment type rule that enables and disables required fields based on the which payment type is selected.

This field uses master data to provide a list of possible values.

To utilize this feature, add a custom field to the document type and use these settings in the Field view:

| Type name | Payment type |

| Name | The name of the field as it appears in the output that is sent to the target system. |

| Display name | Any value. |

| Type | String |

| Accept empty value | Not selected |

| Enforce validation | Selected |

| Use master data to suggest field values | Selected |

| User master data to validate the field values | Selected |

Cash Account

The Cash Account field is used in conjunction with the Payment Type field. When the Payment Type field is set to Entry Only during verification, the Cash Account field is enabled.

This field uses master data to provide a list of possible values.

To utilize this feature, add a custom field to the document type and use these settings in the Document field dialog:

| Type name | CashAccount |

| Name | The name of the field as it appears in the output that is sent to the target system. |

| Display name | Any value. |

| Type | String |

| Accept empty value | Selected |

| Enforce validation | Not selected |

| Use master data to suggest field values | Selected |

| User master data to validate the field values | Selected |

Note

The E-conomic integration can automatically specify day book entry text based on a data template that uses one or more dynamic values. In order for users to add a comment, during verification, for use in the day book entry text, you can create a custom Note field and reference it in the data template which you specify in the Entry text template setting.

To utilize this feature, add a custom field to the document type and use these settings in the Field view:

| Type name | Note |

| Name | The name of the field as it appears in the output that is sent to the target system. |

| Display name | Any value. |

| Type | String |

| Accept empty value | Selected |

| Enforce validation | Not selected |

| Use master data to suggest field values | Not selected |

| User master data to validate the field values | Not selected |

Department

The E-conomic integration can automatically specify the Department value of the day book entry. To make this easier, the integration supports a Department field that specifies the default value for the entire invoice.

- When the Workflow service is not used, the value of the Department field is always used on the day book entry.

- When Workflow service is used, the value of the Department field is used by default, but it can be changed when coding the invoice.

This field uses master data to provide a list of possible values.

To utilize this feature, add a custom field to the document type and use these settings in the Field view:

| Type name | Department |

| Name | The name of the field as it appears in the output that is sent to the target system. |

| Display name | Any value. |

| Type | String |

| Accept empty value | Selected |

| Enforce validation | Selected |

| Use master data to suggest field values | Selected |

| User master data to validate the field values | Selected |

Project

The E-conomic integration supports processing invoices that are linked to projects, even if you do not use the Workflow service. This custom field is only necessary if the Workflow service is not enabled because when the Workflow service is enabled, you normally specify project information during coding. If the Workflow service is disabled, the integration can automatically specify the Project value of the day book.

This field uses master data to provide a list of possible values.

To utilize this feature, add a custom field to the document type and use these settings in the Field view:

| Type name | Project |

| Name | The name of the field as it appears in the output that is sent to the target system. |

| Display name | Any value. |

| Type | String |

| Accept empty value | Selected |

| Enforce validation | Selected |

| Use master data to suggest field values | Selected |

| User master data to validate the field values | Selected |

Cost Type

Cost type information is needed when processing invoices related to projects. You can optionally specify a Default cost type, and you can change the cost type during verification. To make this easier, the integration supports a Cost Type field that specifies the default value for the entire invoice.

- When the Workflow service is not used, the value of the Cost type field is used on the day book entry.

- When Workflow service is used, the value of the Cost type field is used as a default value, but it can be overridden when coding the invoice.

This field uses master data to provide a list of possible values.

To utilize this feature, add a custom field to the document type and use these settings in the Field view:

| Type name | CostType |

| Name | The name of the field as it appears in the output that is sent to the target system. |

| Display name | Any value. |

| Type | String |

| Accept empty value | Selected |

| Enforce validation | Selected |

| Use master data to suggest field values | Selected |

| User master data to validate the field values | Selected |

Employee

Employee information is needed when processing invoices related to projects. To make this easier, the integration supports an Employee field that specifies the default value for the entire invoice.

- When the Workflow service is not used, the value of the Employee field is used on the day book entry.

- When Workflow service is used, the value of the Employee field is used as a default value, but it can be overridden when coding the invoice.

This field uses master data to provide a list of possible values.

To utilize this feature, add a custom field to the document type and use these settings in the Field view:

| Type name | Employee |

| Name | The name of the field as it appears in the output that is sent to the target system. |

| Display name | Any value. |

| Type | String |

| Accept empty value | Selected |

| Enforce validation | Selected |

| Use master data to suggest field values | Selected |

| User master data to validate the field values | Selected |

Image upload service settings

The Image upload service must be enabled.

Master data service settings

In the Master data service settings, make sure Master data on customer level and Let users update supplier data when verifying invoices are not selected. Closed projects, suppliers/vendors, accounts, departments etc. are not imported.

The E-conomic integration supports master data for:

- Suppliers

- Currencies - Learn how exchange rates are handled.

- Payment types

- Departments - Distribution keys are treated as departments in Tungsten AP Essentials.

- Projects

- Cost types

- Employees

- General-ledger accounts - Only accounts that are ProfitAndLoss and Status members (in E-conomic) are imported.

- VAT codes

Process control service settings

The Keep batch together setting cannot be selected.

If you do not use coding suggestions, you can deselect Perform registration step to improve performance. You can also deselect Perform registration step if:

- Online coding is selected in the Source setting. In other words, you use the coding suggestions that Tungsten AP Essentials provides instead of the coding suggestions from the integration.

- Performance is more important than coding suggestions.

Storage service settings

Invoice images are stored directly in E-conomic as a voucher attachment. However, you can enable the Storage service to save invoices in Tungsten AP Essentials as well. If you choose to use Storage services, you can adjust the Storage service settings

Target system service settings

Use the Target system configuration dialog to specify settings that are specific to E-conomic.

Verification service settings

Optionally adjust the Verification settings.

Workflow service settings

This section describes settings you must adjust in the Workflow service.

Account types

The integration supports two types of coding:

- General ledger coding for invoices that require coding for a chart of accounts.

- Project coding for invoices that require a coding on projects.

You must specify different account types in order to distinguish these two different types of coding. Account types can vary depending on the needs of the customer. Project coding is optional and can be ignored if you do not use project coding.

General Ledger

This account type is used for general-ledger coding. When you perform general-ledger coding, you specify the account number and related information, such as the department, VAT code, etc.

To configure this account type, add an account type and use these settings in the Account type view:

| Name | Any value. |

| Internal name | GeneralLedger |

Project

This account type is used for project coding. When you perform project coding, you specify the project number and related information, such as the department, VAT code, cost type, employee etc.

To configure this account type, add an account type and use these settings in the Account type view:

| Name | Any value. |

| Internal name | Project |

Coding fields

This section describes fields that you use when coding invoices in a workflow. Do not confuse these fields with the fields described previously in the Extraction service settings section.

The E-conomic integration supports coding fields related to account types such as:

VAT Code

The E-conomic integration can determine the VAT code:

- from the contra account when using general ledger coding. Use the VAT Code from supplier setting to determine whether the VAT code is taken from the contra account or if it is derived from the InvoiceTotalVatRatePercent field.

- from the cost type when using project coding.

The value can be overridden on a specific coding row using a coding field. This way, you can modify the VAT code for a specific coding row during approval.

This coding field can be used for general-ledger coding and project coding.

To utilize this feature, add a coding field and use these settings in the Coding field view:

| Display name | Any value. |

| Internal name | VatCode |

| Available for account types | Ledger or Project |

| Show coding field as a sub line | Any value (not selected is preferred). |

| Accept empty value | Selected |

| Use coding-field master data | Selected |

Department

The E-conomic integration can determine the department from the Department field if it is used as a header field. However, if the Department field is not used, or if you want to be able to change the value of the department on a coding row, you can do this using a coding field. This way, you can modify the department of a specific coding row during approval.

This coding field can be used for general-ledger coding and project coding.

To utilize this feature, add a coding field and use these settings in the Coding field view:

| Display name | Any value. |

| Internal name | Department |

| Available for account types | Ledger and/or Project |

| Show coding field as a sub line | Any value (Not selected preferred) |

| Accept empty value | Selected |

| Use coding-field master data | Selected |

Note

The E-conomic integration can automatically specify day book entry text based on a data template that uses one or more dynamic values. You can also specify this day book entry when coding a specific row. There are three ways to customize the day book entry text at the coding row level, depending on the Internal name value:

- Text - The day book entry text is set using the Note field value on the coding level. If the coding field is empty, the template value is used. In other words the Text configuration overrides the template value.

- The same internal name as a custom header field - The Note parameter of the day book entry text is set using the template value if the coding field value is not empty or the custom header field value if the coding field value is empty. In other words, using the same Internal name value as the header custom field will override the header custom field value.

- Any other internal name - The custom header field value and the coding field value can be used in the template to set the day book entry text.

This coding field can be used for general-ledger coding and project coding.

To utilize this feature, add a coding field and use these settings in the Coding field view:

| Display name | Any value. |

| Internal name |

|

| Available for account types | Ledger and/or Project |

| Show coding field as a sub line | Any value (Not selected preferred) |

| Accept empty value | Selected |

| Use coding-field master data | Not selected |

Cost type

The E-conomic integration configuration specifies a default cost type value; however, this default value can be overridden on a specific coding row using a coding field. This way, you can modify the cost type of a specific coding row during approval.

This coding field can only be used for project coding.

To utilize this feature, add a coding field and use these settings in the Coding field view:

| Display name | Any value. |

| Internal name | CostType |

| Available for account types | Project |

| Show coding field as a sub line | Any value (Selected preferred) |

| Accept empty value | Any value (Selected preferred) |

| Use coding-field master data | Selected |

Employee

The E-conomic integration can determine the employee from the Employee field if it is used as a header field. However, if the Employee field is not used, or if you want to be able to change the value of the employee on a coding row, you can do this using a coding field. This way, you can modify the employee of a specific coding row during approval.

This coding field can only be used for project coding.

To utilize this feature, add a coding field and use these settings in the Coding field view:

| Display name | Any value. |

| Internal name | Employee |

| Available for account types | Project |

| Show coding field as a sub line | Any value (Selected preferred) |

| Accept empty value | Any value (Selected preferred) |

| Use coding-field master data | Selected |

Coding lines

Select the Coding lines setting according to the customer organization. In most cases we recommend selecting Warn if no coding lines exist.

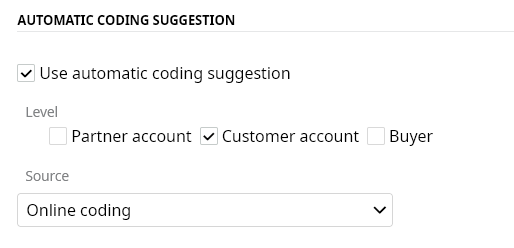

Automatic coding suggestion

Specify the Automatic coding suggestion according to the customer organization. If you use automatic coding suggestions, it must be specified at the customer level.

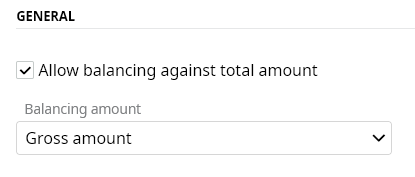

General

Allow balancing against total amount must be selected in order to enforce the amount balancing validation and enable amount-split assistance. You can select Gross amount or Net amount in the Balancing amount setting.