Configure AP Essentials for use with Oracle Financials Cloud

Before you can use the Oracle Financials Cloud integration with Tungsten AP Essentials, you must configure these settings in AP Essentials:

Buyer settings

To limit the inventory items you import from Oracle, specify an Inventory organization code in the target system settings. This decreases bandwidth between systems, and narrows the number of items available to users during verification. In other words, item master data that is not used by your organization is not synchronized, and is not shown to Office users during verification. To increase the specificity even more, specify inventory organization codes on the buyer level. Select Buyer-specific settings (located next to the Inventory organization code setting) to specify inventory organization codes on the buyer level.

Map to legal entities

Mapping buyers to legal entities is the preferred method that accommodates real-world Oracle configurations. To map legal entities, select Map buyers to legal entities in the target system settings, and use the box that appears to specify the business unit name of the legal entity to map to. Optionally, use the Buyer-specific settings to specify business units for individual buyers. The external ID of the buyer specifies a legal entity ID or legal entity name in Oracle.

Map to business units

By default, the integration matches buyers in Tungsten AP Essentials to business units in Oracle Financials Cloud. When Tungsten AP Essentials sends invoices to Oracle Financials Cloud, the business unit name and distribution combination segments are taken from the Buyer settings. The business unit name is taken from the Name setting of the buyer, and the name must match the name of a business unit in Oracle. If perform account coding, distribution combinations are formed using a data template that includes the External ID setting. To customize the data template, use the Distribution combination template setting.

Extraction settings

Edit the extraction settings for each document type and ensure the required Tungsten AP Essentials fields are specified for the corresponding fields in Oracle Financials Cloud. Document types for general expense invoices (non-PO invoices) have different field requirements than PO invoices. If a document type lacks a required field, add a custom field using the field type name specified in the tables later. Likewise, the Oracle Financials Cloud system must use the required fields specified in the tables later.

General expense field requirements

Adjust document types for general expense invoices according to this table:

| Tungsten AP Essentials field type name | Oracle Financials Cloud field | Note |

|---|---|---|

| Header fields | ||

| SupplierName | Supplier * | No need to specify a supplier name field in the document type. The supplier name is taken from master data. |

| SupplierSite | Supplier Site * | Add a custom field with the field type name, SupplierSite. |

| InvoiceNumber | Invoice number * | |

| Business Unit * | For this field, the External ID of the buyer is used. | |

| InvoiceCurrency | Invoice Currency | |

| InvoiceDate | Invoice Date | |

| InvoiceDueDate | Terms Date | |

| Invoice Type * | Set to Standard in Oracle Financials Cloud. | |

| Payment Method * | See Payment method section later. | |

| InvoiceTotalVatIncludedAmount | Invoice Amount * | |

| DeliveryCost | Line Amount | DeliveryCost is used to create a Freight line type in Oracle Financials Cloud. |

| TaxClassification | If a line-item tax classification field is empty, the value is taken from this header field. | |

| ShipToLocation | If a line-item ship-to location field is empty, the value is taken from this header field. | |

| Line-item fields | ||

| LIT_RowIdentifier | Number * | |

| LIT_LineType | Type | When add the LIT_LineType field to a document type, ensure that you select Use master data to suggest field values in the field view, and select LineType in the box under the Use master data to suggest field values setting. |

| LIT_VatExcludedAmount | Amount * | For line-item fields, the line amount

is taken from LIT_VatExcludedAmount.

If the DeliveryCost header field is found in Tungsten AP Essentials, a Freight line type is created in Oracle Financials Cloud, and the line amount is taken from the DeliveryCost header field. |

| LIT_ArticleName | Description | |

| DistributionCombination at the header level or LIT_DistributionCombination at line-item level and/or specify the Default distribution combination setting. | Distribution Combination | This field is not required; however, when it is specified on an invoice, the invoice is considered "Valid" according to Oracle Financials Cloud and can be validated and posted immediately upon entering Oracle Financials Cloud. |

| LIT_TaxClassification | Tax classification |

If this field is empty, the value is taken from the TaxClassification header field, if it exists. To optionally import master data for this field, use the TAX HANDLING settings. Connecting fields to master data provides autocomplete functionality and field validation. |

| LIT_ShipToLocation | Ship-to Location |

If this field is empty, the value is taken from the ShipToLocation header field, if it exists. To optionally import master data for this field, use the TAX HANDLING settings. Connecting fields to master data provides autocomplete functionality and field validation. |

* Required.

If additional data must be mapped to payables header fields in Oracle, or if to override a default mapping to a payables header field in Oracle is needed, use data templates to specify a custom mapping in the Header field mapping setting.

Purchase order field requirements

Adjust document types for purchase order invoices according to this table:

| Tungsten AP Essentials field type name | Oracle Financials Cloud field | Note |

|---|---|---|

| Header fields | ||

| InvoiceOrderNumber | Purchase order number * | |

| SupplierName | Supplier * | No need to specify a supplier name field in the document type. The supplier name is taken from master data. |

| SupplierSite | Supplier Site * | Add a custom field with the field type name, SupplierSite. |

| InvoiceNumber | Invoice number * | |

| Business Unit * | For this field, the External ID of the buyer is used. | |

| InvoiceCurrency | Invoice Currency | |

| InvoiceDate | Invoice Date | |

| InvoiceDueDate | Terms Date | |

| Invoice Type * | Set to Standard in Oracle Financials Cloud. | |

| Payment Method * | See Payment method section later. | |

| InvoiceTotalVatIncludedAmount | Invoice Amount * | |

| TaxClassification | If a line-item tax classification field is empty, the value is taken from this header field. | |

| ShipToLocation | If a line-item ship-to location field is empty, the value is taken from this header field. | |

| Line-item fields | ||

| Number * | ||

| LIT_LineType | Type | When add the LIT_LineType field to a document type, ensure that you select Use master data to suggest field values in the field view, and select LineType in the box under the Use master data to suggest field values setting. |

| LIT_VatExcludedAmount | Amount * | |

| LIT_ArticleName | Description | |

| LIT_UnitPriceAmount | Unit Price |

Required for "goods" purchase orders. When verifying "service" purchase orders, this field value must be empty. |

| LIT_DeliveredQuantity | Quantity |

Required for "goods" purchase orders. When verifying "service" purchase orders, this field value must be empty. |

| LIT_OrderNumber | Purchase Order Number * | This value can also be derived from the purchase order header field (InvoiceOrderNumber). |

| LIT_RowIdentifier | Purchase Order Line Number * | |

| LIT_OrderLineScheduleNumber | Purchase Order Schedule Line Number | Use this field to handle split deliveries. For example, when verifying the first invoice of a split delivery, specify "1" as the field value. For the second invoice, specify "2" and so on. |

| LIT_TaxClassification | Tax classification |

If this field is empty, the value is taken from the TaxClassification header field, if it exists. To optionally import master data for this field, use the TAX HANDLING settings. Connecting fields to master data provides autocomplete functionality and field validation. |

| LIT_ShipToLocation | Ship-to Location |

If this field is empty, the value is taken from the ShipToLocation header field, if it exists. To optionally import master data for this field, use the TAX HANDLING settings. Connecting fields to master data provides autocomplete functionality and field validation. |

* Required.

Context fields

When integrating with Oracle Financials Cloud, use context fields to provide the necessary context for mapping data to descriptive flexfields (DFFs). The integration supports the following flexfield template settings in the target system settings.

-

Descriptive flexfield template – Maps AP Essentials fields to Oracle invoice header descriptive flexfields (DFF).

-

Line-item descriptive flexfield template – Maps AP Essentials fields to Oracle invoice line descriptive flexfields.

-

Global descriptive flexfield template – Maps AP Essentials fields to Oracle global descriptive flexfields (GDF). Global descriptive flexfield template is a buyer-specific target system setting. It is used to populate the invoiceGdf structure in the Oracle invoice payload.

Example

Context behavior

For DFF templates, the integration supports two special fields that can be added to document types. Use these fields to provide context to descriptive flexfield data templates:

-

DFFContext - Add this field at the header level to specify the context for dynamic flexfields on the invoice header.

-

LIT_DFFContext - Add this field at the line-item level to specify the context for dynamic flexfields on each line item. If this field is not added LIT_DFFContext, the system uses the value from DFFContext for all line items by default. We recommend adding LIT_DFFContext for line items if different contexts for each line item are needed.

For global descriptive flexfields:

-

The context is defined directly in the template using the Oracle context code.

-

Global descriptive flexfields do not support global segment syntax as used in DFF templates.

-

The template must reference a valid Oracle GDF context (for example, JAxMYInvoices or JExPLInvoices).

Template syntax

To define descriptive flexfield templates, use the Descriptive flexfield template, Line-item descriptive flexfield template, and Global descriptive flexfield template settings using the following syntax:

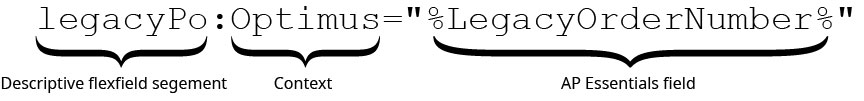

SegmentAPIName:"ContextCode"="%APEssentialsField%"

Where:

- SegmentAPIName is the API name of the segment in Oracle.

- ContextCode is the context code defined in Oracle.

- APEssentialsField is the AP Essentials field whose value will be inserted into the segment.

The flexfield templates are not used unless specify a field value that matches a context code in the template.

The example later depicts a descriptive flexfield template that can be specified in the Descriptive flexfield template setting.

In this example, legacyPo is the API name of a descriptive flexfield segment. It is a literal API segment name defined in Oracle Financials Cloud. The context code matches a context value code in Oracle Financials Cloud. Assume added the custom field, DFFContext, to the document type. In this example, when Office users verify documents, they can optionally specify a value for DFFContext.

- If "Optimus" is specified, the mapping is triggered, and the legacyPo segment is set to the value of the LegacyOrderNumber field when the document data is sent to Oracle Financials Cloud.

- If the DFFContext field is left empty, the mapping above is not triggered, and the legacyPo segment is not set when the document data is sent to Oracle Financials Cloud.

In a real-life scenario, have multiple contexts represented by multiple data templates separated by semicolons. In this case, use master data to populate the DFFContext field with multiple values for the Office user to choose. See more examples in the following table.

Example templates

| Data template | Explanation |

|---|---|

| additionalInfo:"Info"="%Description%";additionalInfo:"Optimus"="%LegacyOrderNumber%" |

|

| additionalInfo:"Info"="%Description%";legacyPo:"Optimus"="%LegacyOrderNumber%" |

|

| additionalInfo:"Info"|"Optimus"="%Description%" |

This example uses the pipe character (|) as an OR operator. If either "Info" or "Optimus" is specified in the DFFContext field, the additionalInfo segment will be set to the value of the Description field. |

| additionalInfo="%Description%";legacyPo:"Optimus"="%LegacyOrderNumber%" |

|

| IRBMUniqueIdentifier:"JAxMYInvoices"="%UniversalUniqueIdentifier%" | Example of a Global descriptive flexfield template for Malaysia. Maps the AP Essentials field UniversalUniqueIdentifier to the Oracle global descriptive flexfield segment IRBMUniqueIdentifier using the context code JAxMYInvoices (Invoices for Malaysia). |

| KsefNumber:"JExPLInvoices"="%KsefNumber%";correctionReason:"JExPLInvoices"="%correctionReason%";TaxPointDate:"JExPLInvoices"="%TaxPointDate%" | Example of a Global descriptive flexfield template for Poland. Maps multiple AP Essentials fields to global descriptive flexfield segments using the context code JExPLInvoices. |

Target system settings

Adjust the target system settings in Tungsten AP Essentials.

- In Admin Center, navigate to the Target system view and select Edit.

- Select Oracle Financials Cloud and select Configuration.

-

Specify the settings in the view that appears.

If synchronize master data for general ledger accounts, choose one of the following. Do not choose both:

-

Synchronize master data using Oracle REST API

-

Synchronize master data using Oracle reports

Using the Oracle REST API is the recommended method that requires the least amount of setup.

-

-

Select Test to test the

connection settings.

Make corrections if necessary.

- Select OK to confirm the settings and return to the Target system view.

- Select Save.

Master data

Tungsten AP Essentials automatically imports master data from Oracle Financials Cloud and uses the data to suggest and validate field values during verification. When importing purchase order data from Oracle, Tungsten AP Essentials only imports purchase orders with the "open" status. To further ensure only relevant purchase orders are imported, Tungsten AP Essentials synchronizes purchase orders by matching the Bill-to Business Unit (Bill-to-BU) in the purchase order to a buyer in Tungsten AP Essentials.

These tables show the correlation between Tungsten AP Essentials master data and Oracle Financials Cloud data.

| Tungsten AP Essentials field (type name) | Oracle Financials Cloud field |

|---|---|

| Supplier master data | |

| Name | Supplier |

| SupplierNumber | SupplierNumber If the Site field is populated in Oracle Financials Cloud, the supplier number is appended with the site name. This helps differentiate suppliers with multiple sites. |

| Description | AlternateName |

| Location | SupplierSite |

| TaxRegistrationNumber | TaxRegistrationNumber |

| TaxCode | FederalIncomeTaxTypeCode |

| CurrencyCode | PreferredFunctionalCurrencyCode |

| State | Addresses[site].State |

| Street |

Addresses[site].AddressLine1 + Addresses[site].AddressLine2 + Addresses[site].AddressLine3 + Addresses[site].AddressLine4 |

| PostalCode | Addresses[site].PostalCodeExtension + Addresses[site].PostalCode |

| City | Addresses[site].City |

| CountryName | Addresses[site].Country |

| TelephoneNumber | Addresses[site].PhoneCountryCode + Addresses[site].PhoneAreaCode + Addresses[site].PhoneNumber |

| FaxNumber | Addresses[site].FaxCountryCode + Addresses[site].FaxAreaCode + Addresses[site].FaxNumber |

| PaymentMethod | paymentsExternalPayees[site].PaymentMethodCode |

| PaymentTerm | If Create a supplier for each supplier site is enabled, PaymentTerm is mapped to [site].PaymentTerms. Otherwise the field is empty. |

| Blocked |

True if:

In all other cases, the value is false. |

| RequirePoForInvoices |

True if all of the following conditions are met.

In all other cases, the value is false. |

| Payment method master data | |

| PaymentMethod See Payment Method section later. |

Payment Method |

| Currency master data | |

| Code | Currency Code |

| Name | Currency Name |

| ExchangeRate | Always "0" |

| Purchase order master data | |

| OrderNumber | OrderNumber |

| SupplierNumber | Suppliers.SupplierNumber |

| CurrencyCode | CurrencyCode |

| DateCreated | CreationDate |

| CreatedBy | CreatedBy |

| SupplierName | Supplier |

| Description | Description |

| StatusText | Status |

| Purchase order line-item master data | |

| OrderLineNumber | lines.LineNumber |

| ArticleNumber | lines.Item |

| SupplierArticleNumber | lines.SupplierItem |

| ArticleDescription | lines.Description |

| UnitPrice | lines.Price |

| CategoryNumber | lines.CategoryId |

| CategoryDescription | lines.Category |

| Quantity | lines.Quantity |

| Unit | lines.UOM |

| StatusText | lines.Status |

| VatAmount | lines.TotalTax |

| RowTotalAmountVatExcluded | lines.Ordered |

| InvoicedQuantity | Invoices.InvoiceLines.Quantity |

| DeliveredQuantity | LinesToReceive.AvailableQuantity |

| DeliveryDate1 | lines.RequestedDeliveryDate |

| DeliveryDate2 | lines.PromisedDeliveryDate |

| Line type master data | |

| LIT_LineType | Type (Freight, Item, Miscellaneous) |

In addition to the master data above, To optionally import tax classification and ship-to location data, use the TAX HANDLING settings.

Payment method

Payment method information is required for incoming invoices in Oracle Financials Cloud. Tungsten AP Essentials can determine the payment method from:

-

The value the user selects in the payment method field during verification.

-

The payment method specified in the master data of the supplier of the invoice.

-

The Default payment method code specified in the target system settings.

-

The primary payment method of the supplier in Oracle Financials Cloud.

The methods above are ordered by precedence. If the payment method field is not specified during verification, the payment method of the supplier master data is used and so on. If the payment method is not specified in any of the points above, the invoice will be rejected by Oracle Financials Cloud.

Several alternatives exist for configuring payment methods in Tungsten AP Essentials, depending on how payment methods are used in Oracle Financials Cloud.

-

If the Oracle setup uses only one payment method, simply specify the Default payment method code in the target system settings. When using this approach, Tungsten AP Essentials sets the payment method automatically, and Tungsten AP Essentials Office users do not need to concern themselves with the payment method during verification.

-

If the Oracle setup uses multiple payment methods, add a custom field to the document type with the Type name set to PaymentMethodCode. When specifying the custom field settings, ensure that you select Use master data to suggest field values and select PaymentMethodCode in the box.

Optionally, we recommend specifying payment methods in the supplier master data and also specifying a Default payment method code in target system settings.

In theory, skip adding the custom field and rely only on the supplier master data is possible, if use supplier master data, and certain the correct payment methods are specified for all suppliers. However, if to do so, think carefully about the consequences. In this scenario, if an invoice indicates that a supplier uses a payment type other than the one specified in the master data, AP Essentials Office users have no way of changing the payment method field.