Amount balancing

You can use several methods to balance amounts when coding invoices:

- Standard debit/credit balancing

- Balancing against the total gross amount

- Balancing against the total net amount

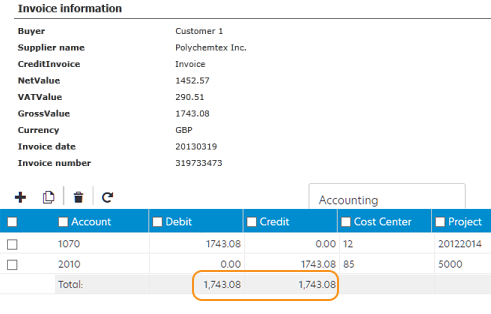

Standard debit/credit balancing

When you perform debit/credit balancing, the total of the debits must equal the total of the credits.

In this example, the sum of the debits equals the sum of the credits.

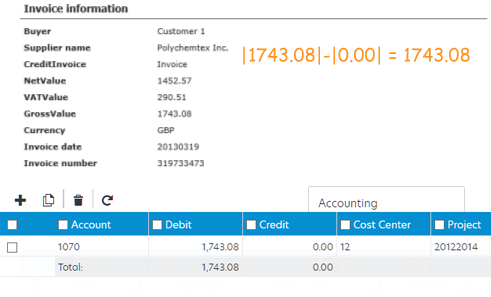

Balancing against the total gross amount

When you balance against the gross amount of the invoice, the absolute value of the sum of the debits minus the absolute value of the sum of the credits must equal the absolute value of the gross amount of the invoice.

In this example, the absolute value of the sum of the debits minus the absolute value of the sum of the credits equals the total gross of the invoice.

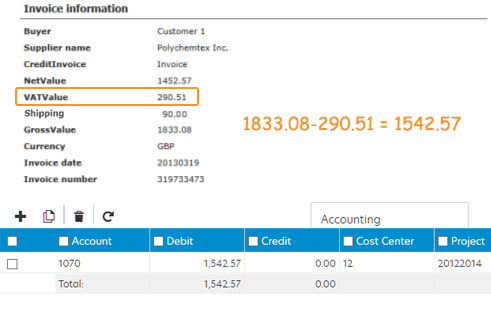

Balancing against the gross amount minus the VAT amount

When you balance against the gross amount minus the VAT of the invoice, the absolute value of the sum of the debits minus the absolute value of the sum of the credits must equal the absolute value of the gross amount of the invoice minus the VAT amount.

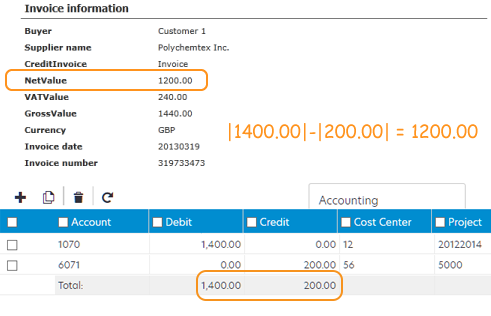

Balancing against the total net amount

When you balance against the net amount of the invoice, the absolute value of the sum of the debits minus the absolute value of the sum of the credits must equal the absolute value of the net amount of the invoice.

In this example, the absolute value of the sum of the debits minus the absolute value of the sum of the credits equals the net amount of the invoice.